The Tech Wreck of 2022 and Effects on Tech Acquisitions in 2023

By Tony Kelly, Excendio Advisors

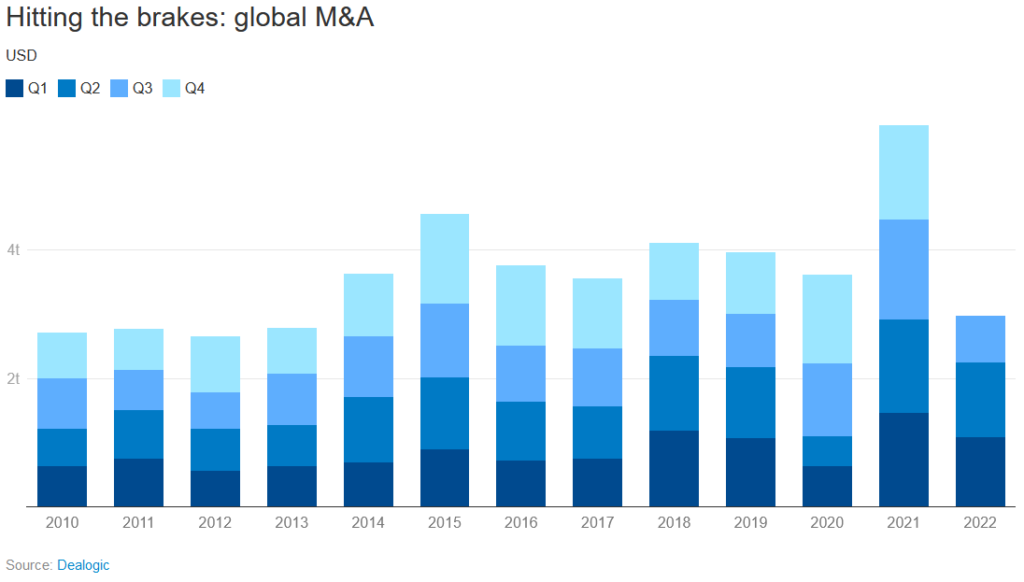

The technology wreck and M&A in 2023 refers to the potential for a massive sell-off of technology stocks and a wave of mergers and acquisitions in the technology sector in 2023. The sell-off could be caused by a number of factors, including a slowdown in the global economy, supply chain interruptions, a fall in consumer demand, inflation, increased interest rates, or a decline in investment in technology startups and small enterprises. Overall global M&A activity saw the lowest level in decades for the first quarter of 2023 with a 48% slump from last year according to Dealogic.

A wave of M&A could be driven by a number of factors, including a desire by larger companies to acquire new technology products and services, or a need to consolidate in a competitive market, smaller firms unable to compete due to lack of funding or increase in interest rates. Valuations are taking a significant dip due to all the uncertainty. So, it may be time for SMBs to take a few chips off the table. Technology transactions slid 18.6 percent by volume and 65.6 percent by value from Q2’22 and continue to slide in 2023.

2021 saw approximately $5.2 trillion worth of mergers and acquisitions. What’s more interesting is that this total previously never reached 4 trillion a year. The technology sector continues to dominate in the M&A realm. There was a 133 percent increase in global M&A to reach $888.2 billion USD of announced deals for 2021, an all-time high. This increase is due to money that sat on the sidelines during the covid pandemic as well as the weakness of some companies coming out of the pandemic and not able to be competitive in the new market environment.

This is a huge jump from the $381.5 billion recorded in 2020. The United States and Europe continue to be the most active markets for M&A, accounting for three-quarters of all deals. China and India were the largest contributors to the M&A activity in Asia. As for industry sectors, the technology sector was the most active in terms of deal value, accounting for $1.1 trillion in global M&A activity. This is followed by healthcare and consumer discretionary, which each had $400 billion in deals.

The surge in M&A activity can be attributed to the Covid-19 pandemic and its accompanying lockdowns, which created unprecedented opportunities for consolidation. Many companies saw their stock prices & valuations drop and realized that M&A could be a way to quickly recover. Additionally, investors have become more willing to take risks in the midst of a pandemic, as they are confident in the potential of a post-pandemic world.

Overall, the surge in global M&A activity in 2021 shows that companies are still willing to invest and grow despite the challenges posed by the pandemic. Technology companies, in particular, are taking advantage of this trend, and are likely to remain the most active in the sector in the coming years.

After soaring to an all-time peak in 2021, the global M&A market has hit the pause button. Early 2022 saw the value of large deals (more than $25 million) fall 24 percent from a year earlier, on a 12 percent drop in deal volume.

But the 2022 numbers match healthy levels and are especially notable in a time of great uncertainty. Geopolitical instability, spiking inflation, supply chain issues, skittish capital markets, regulatory changes—all these factors, and more, are fueling uncertainty. And as Andy West, global co-leader of McKinsey’s M&A Practice, says, “Uncertainty always weighs on decision making, and M&A is a big decision for deal makers. So naturally we’re seeing a bit of a slowdown.” That said, M&A activity is far from dead. Deals are still happening. In the first quarter of 2022, a record-breaking $1.9 trillion worth of M&A activity was announced globally—the highest quarterly value ever on record.

The reasons for this burst of activity are varied. Companies are searching for new growth opportunities, as well as looking to reposition and consolidate in a rapidly changing landscape. “We’re seeing companies look beyond their traditional boundaries for new sources of revenue,” says West. “Or, in some cases, they’re looking to divest noncore businesses to free up capital for investment in more strategic areas.” And the structure of deals is changing, too. “We’re seeing an increasing number of “hybrid deals,” says West. “These are transactions that combine elements of traditional M&A—like cash or stock payments—with other financial instruments, such as debt or equity-linked securities.”

The outlook for the rest 2023 is positive, according to McKinsey’s M&A data. “We’re expecting to see healthy levels of M&A activity in the coming months,” says West. “And that’s good news for deal makers, as it suggests that there are still opportunities to be seized in this uncertain environment.”

Reference:

“Global M&A Market Slows in 2022 First Half- but shows Signs of Strength” Margaret Loeb.